June 10, 2020

•

Read time:

15 minutes

As he sat in his New York office, in a fashionable building in Manhattan, John reflected on his frustrating career.

Most people would have considered his achievements to be the height of success, running his own hedge fund with $2 billion under management and $100 million to his own name. But he felt like his ability was underutilised. He was destined for more.

Back in his college years at NYU, his classmates nicknamed John Paulson “JP”, a reference to JP Morgan, the legendary banker, and a nod to John’s outstanding abilities and huge ambition.

After a career on Wall Street and building a reputation as a playboy, John decided in 1994 that his days of partying were losing their appeal. He knew it was time to get serious and if he wanted to create substantial wealth, he would need to start his own company. He decided to form Paulson & Co, a hedge fund focusing on merger-arbitrage, which was his speciality at the time.

John had a lot of contacts and expected to attract a lot of money for his new venture. But after sending out over five hundred announcements, he didn’t get a single response. It was a humbling experience; being rejected by friends, having people cancel meetings at the last minute and hearing no after no.

He failed to attract any clients at all and so went ahead with $2 million of his own money, partly earned from his Wall Street career and partly from a chance investment in a former colleague’s successful brewery start-up that created the beer brand ‘Samuel Adams’.

After a lonely first year in business, John, riddled with rejection, asked his father if he was in the wrong business. Maybe there was something wrong with him. The thing that kept motivating him was his favourite quote by Winston Churchill, who said, “Never give up, never give up.”

And here he was in 2004, ten years later. He had earned his $2 billion under management the hard way and sweated for every investor. Yet, in terms of booming Wall Street with its super-competitive traders using high-powered computer models, John’s soft-spoken, calm demeanour and intensive research-focused investing style was considered to be unspectacular.

At 48 years old, he was in his twilight years in this fast-paced industry. But he still longed for that one big trade that would prove his worth. Not just another forgettable money manager in an over-crowded market. He was JP and he belonged amongst the elite.

Despite having $2 billion under management, Paulson & Co was only a small company compared to competitors. It had 9 members of staff, one of which was a 47-year-old analyst named Paolo Pellegrini. After graduating from Harvard, rather than moving back to his home city of Milan, Italy, Pellegrini started a career in investment banking. Although he was highly intelligent and great with research, he struggled to woo clients and found his career stagnated. Out of work in 2004, he applied for a job with Paulson, an old friend of his, to become his Chief Financial Officer.

He did not have high hopes of getting the job, but he was desperate. Unfortunately, when he spoke to Paulson, he found the job was already taken. Instead, he asked if he could have a job as an analyst. This was a surprise to John, as an analyst is usually an entry-level job for young people fresh out of college, not for a 47-year-old Harvard graduate with a resume featuring some of the world’s top investment banks.

Despite this, he accepted and Pellegrini started at Paulson & Co as his last shot at making a success of his disappointing career.

Regardless of putting in long hours analysing international mergers, after a year Pellegrini was not making much progress. His work was usable, but he was often left behind from important investor meetings and other employees were not so keen on him. He was disappointed with his work and so was Paulson. Pellegrini was becoming concerned about his position in the company and knew he needed to come up with something special or risk ending in failure once again.

By the height of the dot com bubble in 2000, household borrowing had gone up by almost 60% over the previous 5 years.

This was largely thanks to the invention of securitisation in the late 70s, which basically involved pooling together different loans to create debt securities that could be sold on to investors. These started to really take off in the late 90s and early 2000s, leading to the amount of money available to borrow increasing at an alarming rate.

After the dot com bubble, the Federal Reserve began slashing rates. This low borrowing cost led to home prices starting to surge after 9/11. This began a chain of events which led to an unhealthy rise in the property market and lending that kept prices on a steep incline; best summed up by a viral video of a computerised rollercoaster ride based on the property price chart that ends with an ominous rise, waiting for the inevitable drop.

Lending companies were like crazed addicts looking for more customers to lend to. The riskiness of the loans did not matter anymore since they could use securitisation to repackage the loans and shift the risk on to other investors. In turn, this led to companies becoming dangerously relaxed with their lending criteria and pushing for customers regardless of their credit history and income.

As the Federal Reserve began to raise interest rates again in 2004, Paulson started to get concerned about all the borrowing. He decided it would be the right time to look for some protection for his fund, however, it seemed other investors had the same idea and ‘put’ options for the S&P 500 index, which would pay out if prices fell, were already too expensive.

He looked into shorting financial services companies, but some of them had recently had takeover offers which were squeezing short-sellers by sending prices higher, leading to big losses. He looked into alternatives to protect their portfolio, but nothing seemed ideal.

This was Pellegrini’s chance to show his worth. Not sure if he was stepping out of line, but willing to take the risk, he approached Paulson in the hallway and suggested the firm bought credit default swaps. A credit default swap, CDS, would be like an insurance contract. The firm would pay an annual premium and if the companies’ stock prices fell, they would be due a big payout. If they rose, the only loss would be the premium paid for the CDS.

Paulson asked Pellegrini to research how they could buy CDS contracts on financial companies since that was what he was most concerned about, so Pellegrini went ahead and arranged tutorials from different brokerage firms to learn how they worked.

After two months of dipping their toes in the water with CDS contracts on financial firms, Paulson & Co had only incurred small losses. It was clear that it would be difficult to take a position against a single financial company.

In 2005, the housing and debt markets were still a major concern, but financial companies of big lenders like Countrywide Financial were still gaining. The losses from Paulson’s CDS contracts were causing his returns to suffer in comparison to competitors.

One day, as Pellegrini was discussing Countrywide with Paulson, he suggested an idea. Rather than the companies, why didn’t they figure out how to short mortgage securitisation. If they went bad, there wasn’t the risk of a takeover that could increase the value like with a company, instead, they would stay bad.

The idea intrigued Paulson and sparked the start of a big change in direction for Paulson & Co. Over the next few weeks, they brought in experts from different brokers to teach them about the mortgage securitisation market. They were amazed to find that there were separate categories for subprime mortgages, the riskiest, lowest quality mortgages.

He urged Pellegrini to find ways to bet against the riskiest mortgages, encouraging him to, “Dig deeper, Paolo, dig deeper”.

By the end of the summer, Paulson & Co-owned CDS contracts protecting $100 million of subprime mortgages from defaults or losses and they only paid $1 million for them.

Paulson could not figure out why no one else was buying such cheap protection. It soon became clear that they were too early with the trade, as Paulson realised they were up against a ‘wall of liquidity’. Borrowing by Wall Street banks was surging, “Do you realise these guys are leverage thirty-five to one?” he said.

It was agreed that Pellegrini would shift to focusing on the subprime market full time. This was a sign of the first major shift in Paulson & Co away from their core business, which was in mergers and acquisitions investing. This change in focus for Pellegrini soon proved vital.

At a meeting with mortgage investors, Pellegrini managed to speak to the CEO of New Century, a big lender that offered home loans to people with bad credit. Pellegrini asked him about the possibility of defaults on the loans if mortgage rates rose, thinking he had found the fatal flaw in New Century’s approach. However, the CEO was cool about it and told him they would just refinance the loans if there was any risk of default. They received such high fees from refinancing deals that it was worth it for them, so they would just keep refinancing the deal as long as the underlying properties kept increasing in value. Therefore, no defaults.

With this news, Paulson and Pellegrini realised they had made a mistake.

Because they were covering mortgages on properties that had already increased in value enough that they could easily be refinanced. They sold their CDS contracts and started buying more on recent subprime mortgages instead. Ones that had not gone up in value yet and would therefore not be able to be refinanced if mortgage rates went up.

But they knew things would not be that easy. The only way their trades would work was if the real estate market hit unsustainable price levels and began to fall, leading to borrowers on a large scale being unable to refinance their loans as mortgage rates went up. The problem was, this did not seem possible since everyone saw that home prices had not declined on a nationwide scale since the Great Depression.

Pellegrini sensed trouble and got to work trying to figure out new ideas to solve the issue.

Late one night, he was crunching the housing data, looking at annual price changes across the country. He decided to add a trendline and do some regression analysis to smooth the movements in the market. Suddenly, the answer was right there.

From 1975, prices after inflation had gained just 1.4% annually but had then shot up by an average of 7% per year in the next five years to 2005. He could see that home prices would need to drop by a massive 40% to return to the historic trend line. Even more encouragingly, he could see that any time housing dropped in the past, it actually went through the trend line. This meant any correction would be extremely severe.

He showed his findings to Paulson. Finally, things seemed clear, they had proof the markets were in a bubble and the first key piece of research as the basis of their trades.

They could see that even if prices just flatlined, homeowners would be under extreme financial pressure and there would be losses of 7% for the typical pool of subprime mortgages. However, if home prices did not just flatline but actually fell, even just a drop of 5% would lead to losses on the mortgages of 17%. They had no idea how much prices would fall, but suddenly these underpriced CDS’s seemed like a goldmine.

Paulson ramped up his buying of mortgage protection, purchasing up to $500 million per day, it was dirt-cheap since they were only paying 1% annually for the amount being protected - it seemed too good to be true.

By spring 2006, they had reached their limit of what they could handle and, although trying their best to stay silent on their findings and not reveal their secret to anyone, they set out to raise money for a new fund to take advantage of what they thought was the trade of the century.

Despite many new funds raising billions of dollars, Paulson’s new fund only managed to raise $147 million, which included $30 million of his own money. It was a disappointing amount, but he was afraid the opportunity was drifting away and so he decided it was now or never. Time to make use of the money and start buying.

They would mix up their trades between CDS contracts on slices of selected mortgage bonds and the entire ABX subprime mortgage index that was launched in 2006.

Their brokers were so shocked that anyone would want to buy the CDS contracts that they would actually speak to Paulson and his team to try and encourage them to stop since they were sure they were making a mistake and wanted to protect their client.

By late 2006, Paulson had gained a bit of a buzz and as more investors became wary of the property market they chose to invest in Paulson’s new fund, leading to the fund having $700 million under management. They immediately spent it all on mortgage protection and launched a sister fund to keep making similar trades.

Despite his huge positions, Paulson began to get concerned about the consequences if a crash did happen. Who would be liable for all the insurance he had bought? They did not know who was selling them all the insurance but they knew if the seller was in trouble it would be a bad situation for the investment banks and maybe bring down the financial system. They needed to broaden the trade and prepare for this.

One of the companies they shorted was New Century.

Their share price had been increasing as they announced good results each quarter. Paulson thought they were lying and he knew if they were then their end of year results would show it since those would have to be audited and would reveal the truth.

Immediately he got a call from a salesman cautioning him about shorting the shares, explaining that David Einhorn was the largest shareholder and would have done his due diligence.

Paulson stood his ground. He felt he was right.

And he was. In February 2007, they announced their earnings for the fourth quarter of 2006 and it showed so many of their borrowers were struggling to pay their loans that the company was having to take back loans it had sold to banks. They were in trouble. The next day their stock dropped 36% - Paulson’s first big profit.

As a result of that, the ABX index also dropped 5 points. For Paulson, a 1 point move in the ABX index was worth $250 million, so a 5 point drop meant Paulson & Co had just gained $1.25 billion in just one morning.

A few weeks later when the fund was due to report to investors, the head of investor relations complained about a misprint. Surely, the monthly gain in February couldn’t be 66%? It must be 6.6%! No, the results were correct and the fund was flying.

Over the coming months, a battle ensued. The big players involved in the market, such as Bear Stearns, battled to prop up the market and encourage buying in subprime mortgages. Paulson was having to argue against his investors, his team and even Pellegrini who wanted him to sell his CDS positions and avoid losing the gains they had made, which then stood at $2 billion.

But Paulson thought the bonds would go to zero, so he ignored everyone and held on. The trick for him would be to exit the positions just in time to actually be able to take a profit from the financial institutions that would be in trouble.

Knowing how much trouble investment banks would be facing, Paulson and his team got to work trying to estimate how exposed certain banks were. The deeper they looked, the more they realised how overleveraged the banks were and how many of their assets were difficult to price or sell and would, therefore, cause major problems.

Yet the CDS contracts, to insure against investments in these companies, were dirt-cheap. It was just $200,000 to insure against $100 million of Bear Stearns debt. Paulson began buying up CDS protection on all the major players.

As the inevitable collapse and financial crisis began to take hold, Paulson began to offload his positions. The ABX index had crashed below 50 and investors around the world were moving away from risk in a panic. He had ignored the complaints from his team and investors long enough and maximised the profit, but now it was time to start selling off before it was too late.

By July 2008, subprime investments had completely crashed and Paulson had exited almost all trades. In the space of just two years, the two credit hedge funds Paulson had set up had invested $1.2 billion and returned a profit of $10 billion. His other funds also made their own gains of $10 billion.

Everyone told him his investments were worthless and would not work, but he stuck with his guns and went down in history for achieving the greatest trade of all time.

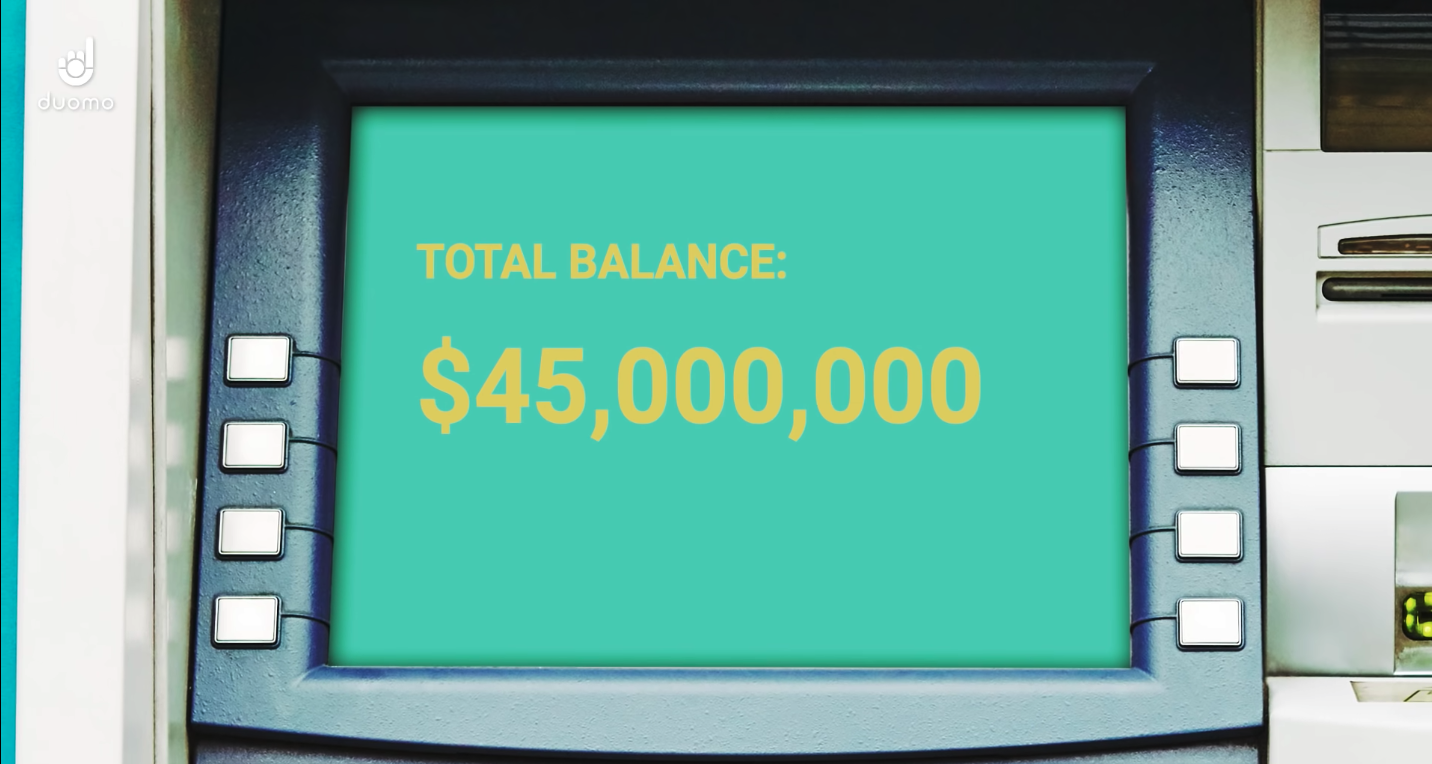

Pellegrini was on holiday in the Caribbean with his wife, when she went to an ATM machine to withdraw some cash. She checked the balance just as his bonus had hit the account. She knew things at the fund were going well but Paolo had been so secretive about their trades, that she did not know quite how well. She could not believe her eyes, the balance in the account was

Pellegrini, who joined Paulson as an analyst, in desperation, as a last-ditch attempt to save his failing career and improve his terrible financial position, was now worth $175 million after just a few years.

And, as for Paulson, he had finally hit the elite level he had been dreaming of. His personal cut from the amazing success was $4 billion, the largest one-year payout in the history of the markets. JP had proven himself.